Let's Revisit $CABO

No. Not that Cabo.

Cable One (CABO) is a rural/small-town cable company that was spun out of the Graham Holding Company (GHC) in 2015. Initially priced at $400/share, CABO went straight up for the first six years of its public life. It peaked in 2021, just shy of a six-bagger, due to its differentiated strategy and good operating by management. Poor capital allocation decisions during the ZIRP-era resulted in a precarious balance sheet situation. Combined with the general disfavor shown to the cable/telecom industry as of late, the stock has spent the last four years completing a portrait of Mount Doom.

Quick Pitch

- ~3.25x FCF at current price of $139/sh

- ~1x LTM EBITDA, 5.3x EV/EBITDA

- Significant hair (details below):

- Broken Converts

- The MBI Put

- New Competition

- Management has turned over (new CFO, searching for new CEO) and is finally committed to deleveraging, which will eventually be accretive to equity.

- Assuming all FCF is applied to fixing the balance sheet situation, and the debt stack is refinanced at 10% rates, CABO in 2030 will generate ~$150M of FCF, $900M of EBITDA, with $4B in debt.

- At a 10% FCF yield in 2030, implied price is $266/sh, or 91% upside.

- If it actually takes five years, that is a 14% CAGR. I suspect it will take less as the balance sheet uncertainty is resolved over the next 12-18 months.

- Upside optionality:

- FCF is extremely sensitive to refinance rates. Each 1% difference (from my 10% assumption) equates to ~$20M of FCF and $35/sh in value.

- Market cap is extremely sensitive to M&A multiples. Each turn on EV/EBITDA is good for $160/sh. If M&A picks up, could be explosive.

As you can see, the potential upside is immediate. The real decision to make is in assessing the downside scenarios of the balance sheet problem. For that, you’ll have to read on and judge for yourself.

Background

I don't normally dive this deep into company history, but in this case, I think it is useful to understand how CABO differs from most cable internet companies, and how it blew such a hole in its balance sheet.

In The Beginning

The architect of Cable One’s spin was Thomas Might. Mr. Might spent basically his entire career at the company, leading it both as a division of GHC and as the CEO for the first few years of its public life.

Mr. Might and his executives recognized the declining economics of cable video early. Cable companies were being squeezed between content providers and price competition, leaving little margin for profitability. By 2012 they had committed to a new strategy to focus all efforts on selling/growing high-speed data (HSD), which is higher margin because there are no content providers to pay:

Three years ago this summer, we turned our attention away from video and the triple play as centerpieces of our long-term strategy based on several trends that we started seeing back then and even though video was over half our revenues and units back then. We saw then that cable TV started losing video subs in 2007, 5 years earlier. The total pay TV industry started losing household penetration in 2010, 2 years earlier. Cable ONE's video gross margins had dropped 13% in just 2 prior years, and Netflix, Hulu and YouTube had started the OTT evolution a few years earlier, that may now be a revolution. On the phone side of the triple play, total landlines were dropping at about 10% per year across the U.S. despite cable phone's temporary success, and phone ARPUs were falling even faster than that.

So we decided that what would eventually be left of the triple play with HSD only, and our cost analysis was that virtually all of the triple play profit had already shifted to HSD, thanks to forces like programmers, cellphones, Vonage-like companies, the FCC and many other forces. Cable ONE's strategic decision in 2012 was to confront these brutal facts and not pretend we had the wherewithal to repeal them. Since then, we have been optimizing the inevitable transition to an HSD-only dominated residential business.

(Thomas Might, CEO, August 2015 Earnings Call)

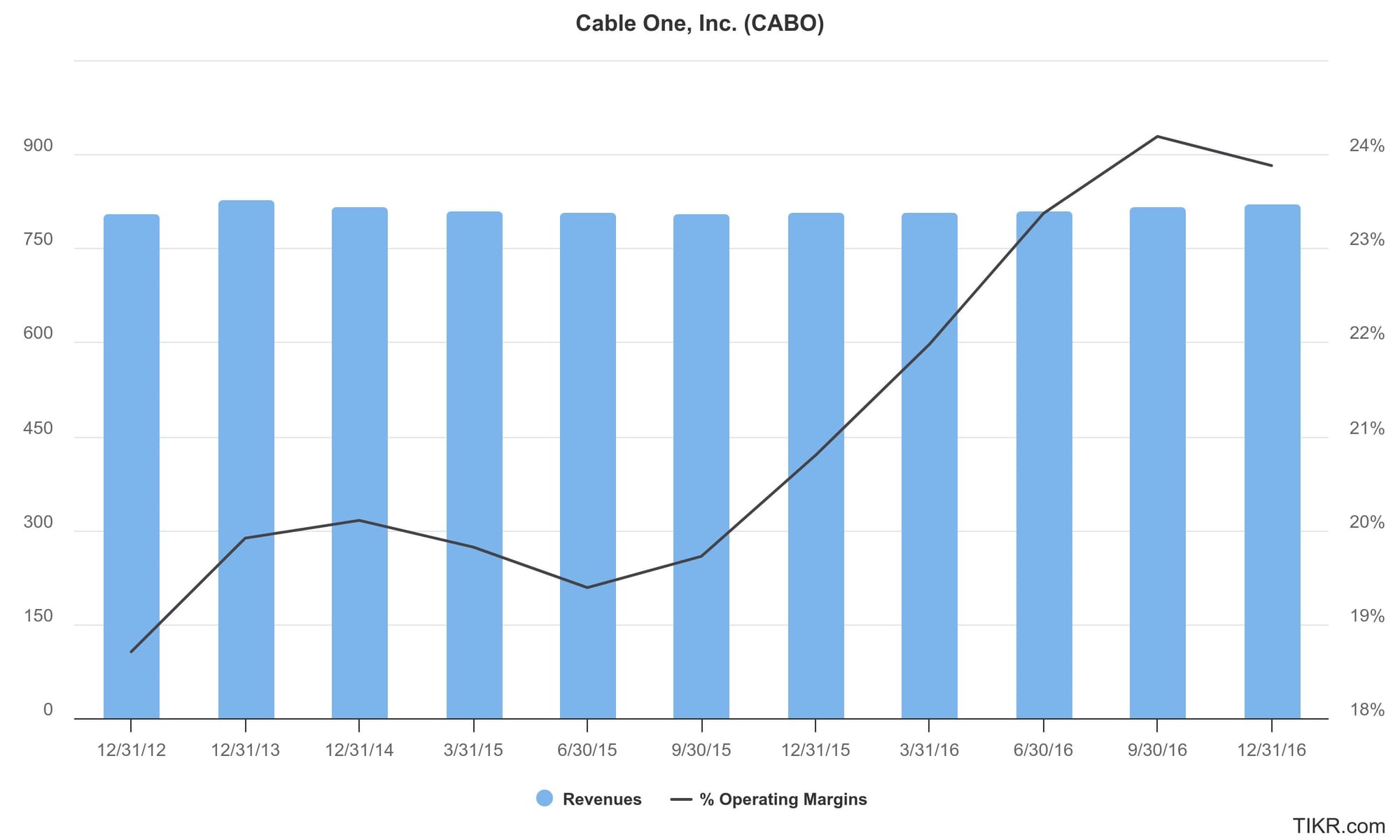

This strategy was differentiated and ahead of its time. For several years, Cable One had stagnant revenue as video subscriptions declined. However, CABO’s new HSD core was growing at a steady rate, so margins were steadily improving despite the stagnant revenue.

On a later earnings call, Mr. Might summarized the company strategy in five points (emphasis mine):

1. Fully allocated cost models. We strongly believe it is more important to look at long-term operating cash flow trends by product, which we also refer to as adjusted EBITDA, and free cash flow trends by product, rather than contribution or gross margins by product. In other words, we like to fully allocate all cost when we look at business trends and results. Every cable company has very significant indirect operating cost and capital cost per PSU. Contrary to conventional thinking, they are both highly variable, not highly fixed, thus, our fully allocated cost models.

2. What we don't like. Residential linear video and phone, for many reasons, produce very modest operating cash flow today and no free cash flow to speak of. That is, they have no real margin left, and volumes are challenged as consumers want to migrate to alternatives like smartphones and OTT video, that is cutting, trimming, shaving, avoiding or whatever the cords.

3. What we do like. Residential HSD and Business Services, on the other hand, have healthy operating revenue growth and free cash flow margins and have produced double-digit growth rates. So that is where we are investing: In the future rather than in the past.

4. Lifetime value matters to us. The lifetime values of customers and potential new starts vary dramatically as well. Not only by package, but also by demographics. Historically, many of our new starts were unprofitable and subtracted from our bottom line a lot. Other starts are highly profitable. Letting go of large quantities of unprofitable starts that used to prop up PSU counts has reduced PSUs significantly, but has also increased our cash flow.

5. Business mix and margins. As our mix of revenue shifts away from video and phone and towards residential HSD and business services, our operating cash flow margins are already expanding predictably, up almost 300 basis points since 2013, and so should total revenue within the next few years. Residential HSD and Business Services have grown from about 1/3 of total revenues to nearly 1/2 in just 3 years on relatively flat revenues, which is why we see this as a margin expansion strategy at least at this time.

(Thomas Might, CEO, March 2016 Earnings Call)

(Note: “PSU” is “primary service unit”, which is cable-industry-speak for a single subscription. A traditional “triple-play” is three PSUs, one for each of video, data, and voice.)

CEO Transition

Mr. Might retired as CEO at the end of 2016 and became Executive Chairman. The board appointed Julie Laulis as the new CEO. Ms. Laulis had been with the company since 1999, and had been COO since January 2015. As part of the announcement, Mr. Might said he intended to remain active as Executive Chairman, focusing primarily on business development and strategy. With Ms. Laulis focused on day-to-day operations, this transition was, by all indications, a non-change.

In her first earnings call, Ms. Laulis summarizes the company strategy thus (emphasis mine):

Ultimately, our focus remains on long-term performance through a combination of continued subscriber and revenue growth along with sustained margin expansion, particularly for our faster growing residential HSD and business services products.

(Julie Laulis, CEO, February 2017 Earnings Call)

This was a subtle shift, portending the next eight years of CABO’s life. On the surface, the focus was still on HSD and business services, both of which were high margin and growing, while letting video and voice atrophy. However, the focus leads with “subscriber and revenue growth”, which stands almost in direct contrast to Point 4 of the five-point strategy outlined above, which states that “PSU counts” should not be the metric of success.

Immediately following the CEO transition, CABO announced the acquisition of NextWave Communications for 6.6x EBITDA. The acquisition price was roughly 20% of CABO’s market cap, so was significant, but not transformative. Obviously, this acquisition was in the works before the transition and Mr. Might likely led the effort.

In the case of CABO, this is compounded by consolidating EBITDA from equity method investees. That EBITDA is about as useful as monopoly money when it comes to paying bills.

When it comes to making decisions, I’ll always use FCF (OCF - capex/SBC) instead of EBITDA. For purposes of chronicling CABO’s acquisitions, I’ll quote EBITDA because those tend to be the numbers provided, and because determining an absolute value is not really the point.

Together, the new focus on revenue/subscriber growth and acquisitions represented a significant change in strategy. The NextWave acquisition closed in Q2 2017, and the aftermath represents the only blip in the otherwise relentless share price appreciation. The stock went sideways-to-down for about a year.

Goldilocks Years

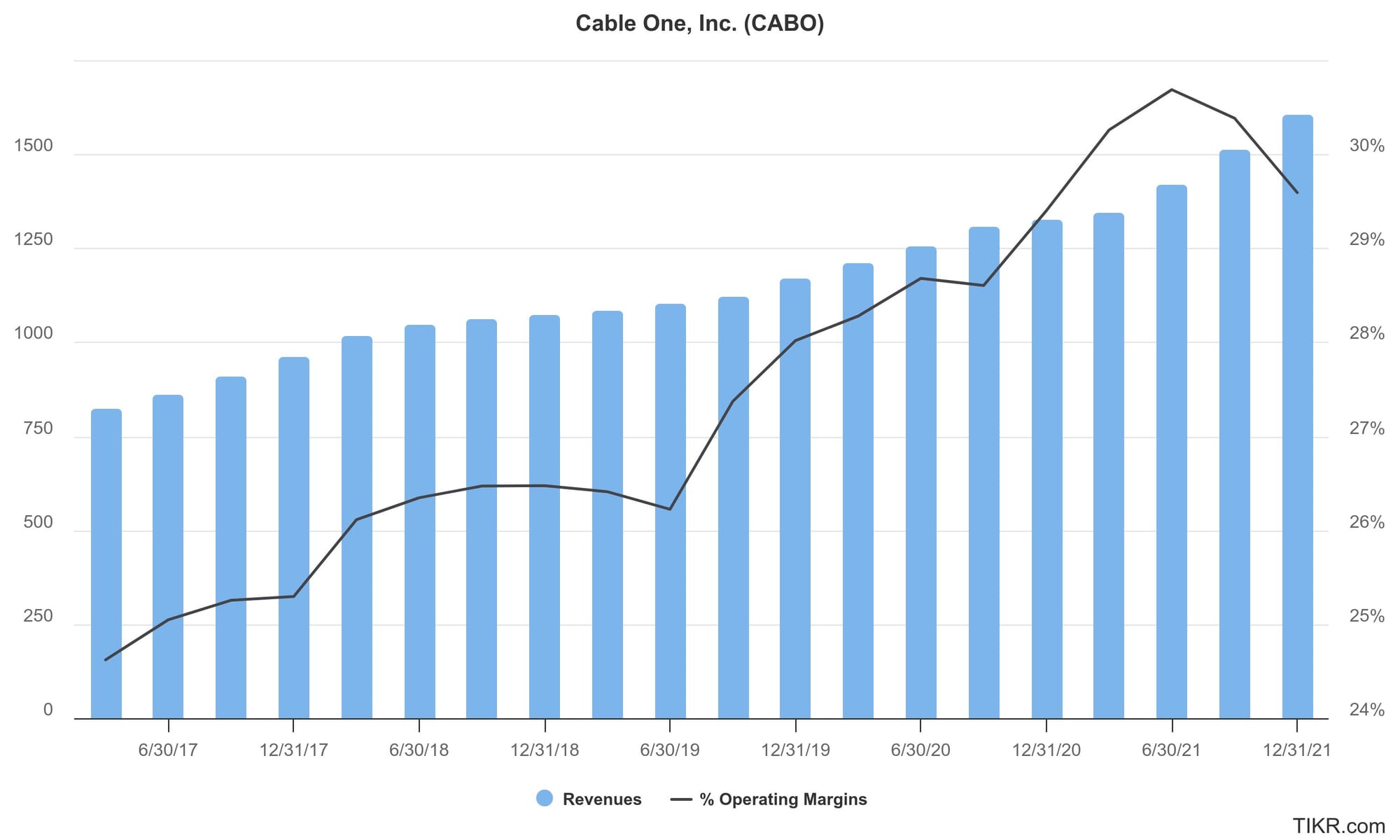

Ms. Laulis’ focus on growing subscribers and revenue was a smashing success, at least on the income statement. In contrast to the initial few years of video-to-HSD transition under Mr. Might, CABO managed to grow revenue steadily while sticking to cost and margin discipline:

The source of the growth was a combination of price increases, acquisitions, and riding the general broadband adoption wave. CABO is a rural/small-town operator, and in many territories has no actual competition. CABO's traditional competition was DSL, provided by ILECs (local telephone companies). As CABO’s network speeds eclipsed 10mbps, DSL could no longer compete.

Penetration rates (PSUs/Passings) of rural cable operators are low, usually below the 40% threshold that traditionally attracts competitors. At the time of the CEO transition, CABO’s penetration rate was 38.6%. CABO usually had a town to itself, and it was rolling up new territory with similar monopoly characteristics via acquisition.

Additionally, part of CABO’s strategy was to be ahead-of-the-curve on broadband speed and capacity. Other HSD operators spent the 2010s implementing bandwidth caps to keep networks usable in the face of exploding demand growth. CABO was racing ahead, offering higher speeds with no caps, without price increases (they already charged premium prices). CABO offered 1gbps speeds company-wide by the end of 2016, something larger companies were doing only in dense metro areas.

This best-in-class operation and ability to compete on speed and capacity, not just price, kept competitors at bay. Why compete with CABO in a bunch of rural low-penetration markets where you’d have to commit extensive capex dollars when you could go after an easier, denser market somewhere else?

The ZIRP Era

The Pandemic was a boon for internet providers. Demand shot up as everyone needed to get online to work and people spent more time at home consuming bandwidth. Government subsidies were enacted to help low-income households get online. As a rural provider, CABO picked up a lot of new subsidized customers. You can see the acceleration in revenue and margins during the pandemic in the chart above.

But the Pandemic also brought us ZIRP, which was a wolf-in-sheep’s-clothing.

Debt-fueled Acquisition Spree

Most immediately, the availability of near-zero-cost debt allowed CABO to add a lot of it. Held steady at less than 20% of total capitalization under Mr. Might, debt ballooned under Ms. Laulis. The $530M in debt at the time of the CEO transition quadrupled to $2.1B by year-end 2020, as Ms. Laulis made a series of acquisitions.

On the acquisition and investment front, it has been a busy time at Cable One. In addition to closing our acquisition of Valu-Net in the third quarter of 2020, and we have completed 5 strategic investments over the past 13 months with a cumulative book value of nearly $750 million. This includes our partnership with Mega Broadband Investments [MBI] that closed during the fourth quarter.

(Julie Laulis, CEO, February 2021 Earnings Call)

She was not alone. The entire industry engaged in an orgy of acquisitions as interest rates fell, and companies were trading at nosebleed high-teens EBITDA multiples.

In 2021, debt increased 77% to $3.8B as CABO acquired the 85% of Hargray Communications that it did not already own at a $2.2B valuation. This purchase price implied a ~17x multiple of adjusted EBITDA (bullshit squared). Hargray brought CABO 125,000 customers in South Carolina, Georgia, Northern Florida, and Alabama.

In sum, during the first five years of Ms. Laulis’ tenure, debt increased by over 7x, while operating income and operating cash flows only increased by 2.5x. All of this was made possible by near-zero interest rates.

The Hargray acquisition was announced in February of 2021, about six weeks after the absolute peak in the stock price. It has been falling ever since, as the balance sheet situation has become more acute/apparent, and the cable industry has fallen out of favor with investors.

New Competition

ZIRP also provided cheap funding for new competition. There was a minor fad of raising cheap debt and PE money to build out fiber networks, and some of this money got put into the ground in CABO’s territories. On its Q2'25 earnings call, CABO estimated that 53% of its territory has been overbuilt by fiber, and all of its territory is covered by Fixed Wireless (FWA).

Since it takes time to build a fiber network, this new competition was not immediately apparent. However, it has started to rear its head in earnings for the last few years. For the first time since outrunning DSL providers by offering superior bandwidth, CABO has competition and has to engage in protective pricing actions (i.e. promotional rates).

The Hangover

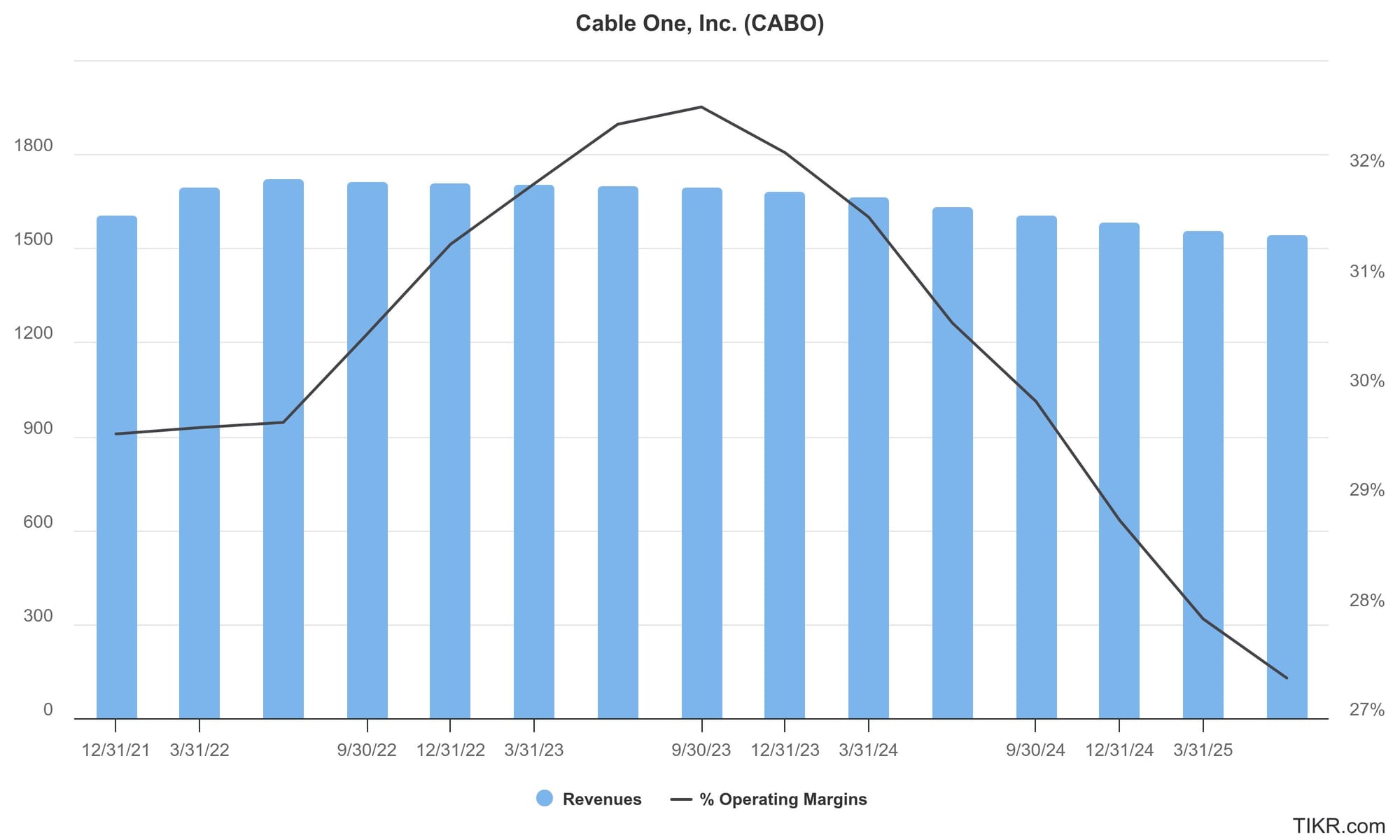

The company’s performance has been slowly declining since the Pandemic peak. Revenues have been in a slow decline. Operating margins have contracted back to 2020 levels as operating expenses have stayed flat. (Given inflation over this timeframe, flat expenses is an achievement.)

The stock price has obviously changed in much less subtle ways, mostly due to extreme multiple compression.

CFO Out

Steven Cochran, CFO, tendered his resignation on April 8th, 2022. The following Monday, the Board selected Todd Koetje, SVP of Business Development and Finance to replace him. Mr. Koetje joined the company from Truist Securities in 2021.

In terms of the business, Mr. Cochran went out near the peak. Revenues (LTM) hit their all-time-high the last quarter he was CFO. Margins continued to improve for the next year. But the stock price was already down over 50% from the peak. In his last six months, Mr. Cochran executed the company’s most significant buyback, spending over $200M on shares at ~$1000/sh.

Mr. Koetje continued this buyback during his first year as CFO. His first quarter saw $115M in purchases, then $40M/quarter for the next three. The buyback was abandoned during Q3 2023 in the face of a relentless price decline. The stock had fallen another 50% during Mr. Koetje’s first year.

There is some indication that the buyback was abandoned because the balance sheet situation was coming in to focus. Around the time the buyback stopped, Mr. Koetje started a program of steady debt paydown at the rate of $55M/quarter.

I cannot help but wonder if applying the $450M spent on buybacks towards the debt situation, or even just building cash, would’ve helped the stock avoid the current lows.

Might Out

Mr. Might notified the board in January 2025 of his intent to not stand for renomination at the next annual meeting. Mr. Might is 73 years old, and has been with the company for 30 years. He likely realizes the opportunities for business development and strategy in the next few years will be slim.

Dividends Out

The Board suspended the dividend during Q1 2025. This frees up $67M/yr in cash.

Laulis Out

On June 3rd, 2025, the Board announced that Ms. Laulis will retire as CEO and Chair of the Board (and will leave the board), at the earlier of the end of the year or when her successor is named.

While the announcement is a “retirement”, I think it is clear that Ms. Laulis was fired and given a graceful exit. Consider four facts:

- Both the press release and 8-K use the phrasing “the Board announces the retirement of…” rather than “Ms. Laulis notified the Board of her resignation/retirement” (the phrasing used for Mr. Cochran’s resignation). Subtle difference. Since 8-K’s are material information, saying that Ms. Laulis retired/resigned when she in fact did not initiate it would be misleading investors, so I think the phrasing is significant.

- Ms. Laulis’ complete exit of all of her roles (CEO, Chair of Board, and Board Member) simultaneously is not how retirements usually go, and not how they went for Mr. Might. A friendly ex-CEO usually would stay on the Board or get a consulting arrangement during the transition.

- No heir apparent was available at the time of the “retirement”. If the retirement were elective, the CEO would normally spend their last year or two grooming their replacement.

- Ms. Laulis made no mention and gave no indication of this transition on her last earnings call, held only one month before the announcement. The same call announced the suspension of the dividend.

I view this turnover in management and the suspension of the dividend as extremely positive, because it means the Board is awake and aware of the balance sheet issues.

Background Summary

I think there are three takeaways from this little speedrun through company history.

- Cable One is a solid operator with a good strategy of focusing on higher margin data and business services in defensible rural/small-town territories.

- Cable One has a balance sheet problem because it went on a shopping spree with cheap debt. It also potentially has a revenue problem due to ZIRP-funded fiber overbuilders and fixed wireless.

- The Board and the CFO are aware of this problem and are (slowly) moving to correct it.

The rest of this article examines the balance sheet problems and stress tests the effects of new competition.

Hairy Things

CABO’s stock price has been descending Mount Doom for four years straight, and has now lost a staggering 95% of its value.

This decline is due to a confluence of factors.

- At its peak, CABO was trading at 25x adjusted EBITDA (again, bullshit squared). This was slightly superior to industry-wide multiples, which were closer to 20x, due to the fact that CABO was seen as a superior operator. It now trades at a 5.3x multiple, which again, is in-line with the industry today.

- EBITDA peaked in Q2 2023, and has been declining since. So has operating income, operating margins, and operating cash flow. All are back to 2020 levels.

- The balance sheet situation has become more acute and apparent to investors.

We can’t do much about multiple compression, and I think betting on multiple expansion is a fool’s game, but we can examine the latter two points.

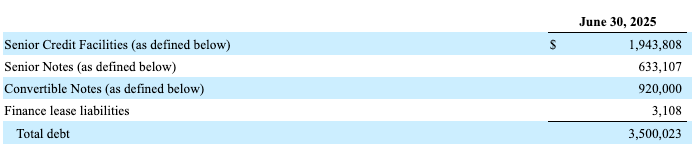

Broken Converts and the Debt Situation

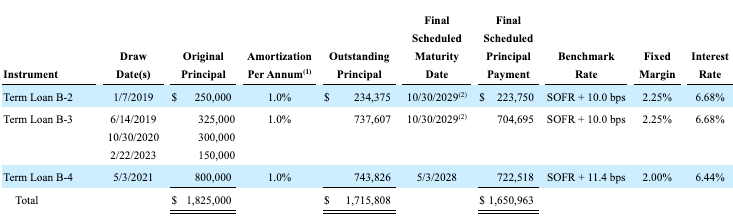

The good news about Cable One’s debt is that it is nicely termed out, with low rates to 2030. The majority of the debt stack is made up of term loans. These term loans are floating rate, but in 2019 and 2020 CABO acquired floating-to-fixed swaps expiring in 2029 on $1.2B notional, locking in low fixed rates. In the most recent quarter, their effective cash interest rate was 3.9% on all of their debt.

Aside from the term loans, they have:

- $633M Senior Notes due 2030 at 4% fixed

- A $1.25B revolver at 6.2% variable with only $203M drawn (as of July 31st, 2025 Earnings Call)

- Two convertible notes:

- $575M at 0% due March 2026

- $345M at 1.125% due March 2028

These convertible notes are extremely busted. They were issued at the top of Mount Doom in March, 2021 to pay for the Hargray acquisition. Struck at a 25% premium to the stock price at that time, the conversion price is $2275.83/sh!

It is clear the convertible notes were never meant to be repaid. The CFO at the time even says the quiet part out loud:

[C]learly, I think we probably look at the converts as quasi-leverage just from the standpoint of we clearly anticipate that those will convert over time and they're not debt.

(Steven Cochran, CFO, August 2021 Earnings Call)

Yikes.

The MBI Put

In 2020, CABO acquired 45% of Mega Broadband Investments Holdings LLC (MBI) for $574M in cash, or about 11x EBITDA. MBI is executing a similar strategy to CABO, and had $320M in revenue LTM, so is about 20% of the size of CABO. CABO accounts for this investment using the equity method.

As part of that acquisition, CABO acquired a call option on the remaining 55% at a fixed multiple (undisclosed) which could be exercised between January 1st, 2023 and June 30th, 2024. CABO let this option expire, presumably because the multiple was much higher than where the industry traded at the time.

However, MBI also received the option to put the remaining 55% to CABO at a fixed multiple. This multiple is different, presumably lower, and is also not disclosed publicly. The put option was exercisable during Q3 2025 for a Jan 1st, 2026 close.

At the eleventh hour (Q4 2024), CABO and MBI negotiated a stay of execution. In exchange for $250M in cash (the “Upfront Payment”), the following new terms were agreed:

- CABO receives a new call option, exercisable any time after Q2 2025. The strike price is reduced by the amount of the Upfront Payment ($250M).

- MBI gets a new put option, exercisable any time after January 1st, 2026. The strike price is also reduced by the amount of the Upfront Payment ($250M).

- MBI incurred an additional $100M in debt and used the proceeds to pay the owners of the 55% not owned by CABO a cash dividend. This debt will be excluded from the debt amount used to calculate the strike price of the call/put options.

- The closing of the put, regardless of when exercised, is not allowed to occur before October 1st, 2026. If MBI chooses to force closing before that date, the strike price is discounted at a 12% annual rate.

In sum, in order to buy itself an extra year, CABO effectively pre-paid $250M toward the eventual acquisition and allowed MBI holders to cash out $100M via debt that it will eventually assume.

If/when exercised, CABO estimates it will pay between $460-510M in cash and assume $845M-$895M of MBI’s debt.

Simple Math

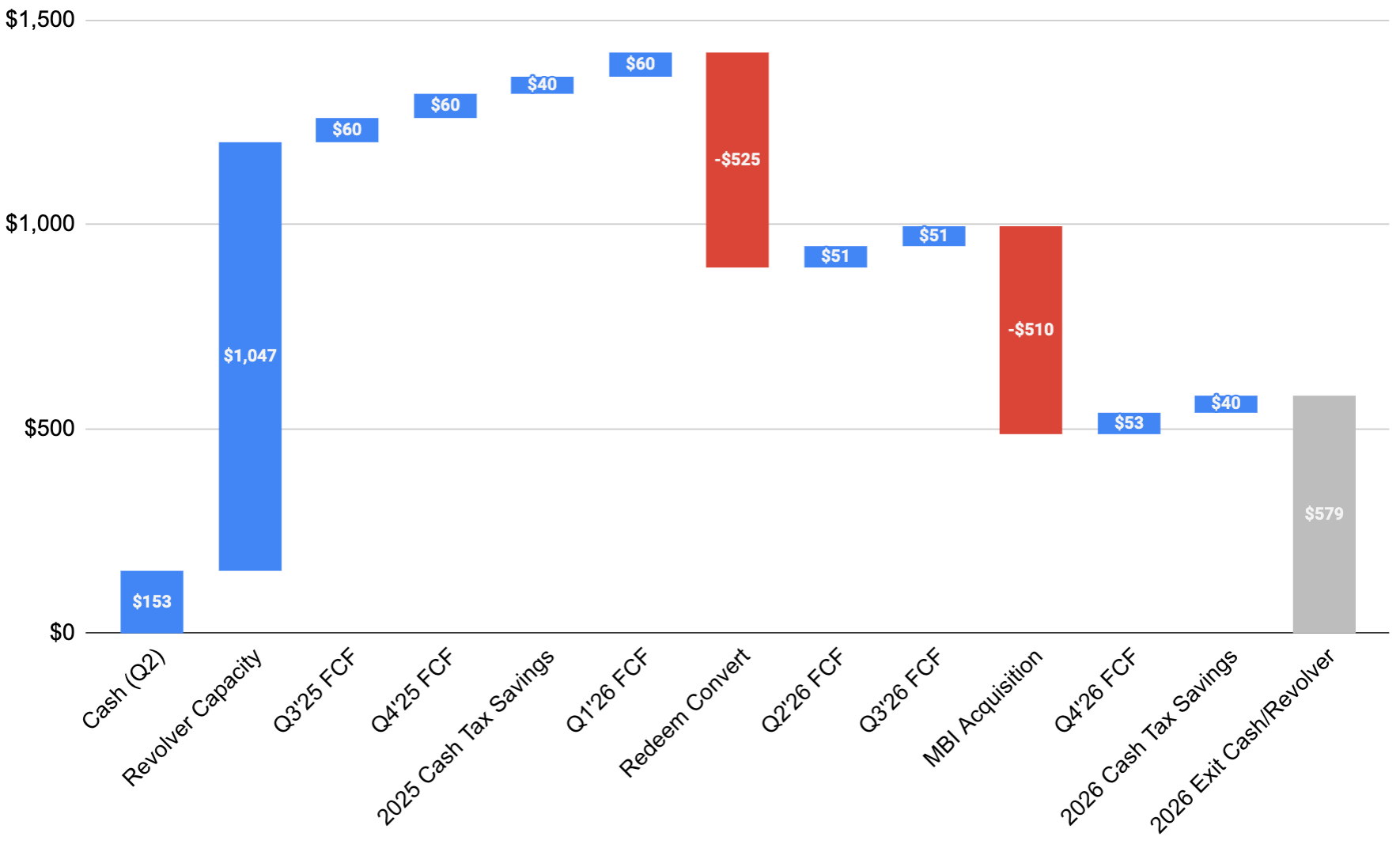

So in 2026, CABO has two big cash flow events. The $575M converts maturing in March, and the potential close of the MBI put for $460-510M in October. Taking the top of the range, that is $1.085B.

Against that cash need, as of July 31st, 2025, the company has $152M in cash and $1.047B of revolver capacity, totaling $1.2B. The CFO makes it clear that handling it all with the revolver is their plan:

Between our free cash flow generation and the substantial available capacity under our revolving credit facility, we expect we will be able to fully retire our 2026 convertible note maturities without needing to arrange for additional financing.

(Todd Koetje, CFO, July 2025 Earnings Call)

Speaking of FCF, annualizing off H1, 2025 figures (which are a bit pessimistic due to working-capital changes), the company should generate ~$60M/quarter of FCF, with five quarters until the MBI put closes, giving $300M in additional cash.

Additionally, the recently-enacted tax cuts by the Trump Administration throw CABO a huge bone:

With the passage of the tax bill earlier this month, we expect to realize approximately $40 million of cash tax savings in 2025 and approximately $120 million of aggregate cash tax savings through 2027 based on our preliminary estimates and available information.

(Todd Koetje, CFO, July 2025 Earnings Call)

Taken together, CABO actually has about $575M of wiggle room on its balance sheet. In fact, FCF could evaporate completely, and the tax benefits not materialize, and CABO would make it through this crunch period with $165M of cash/revolver capacity.