Cable One Q3 Earnings

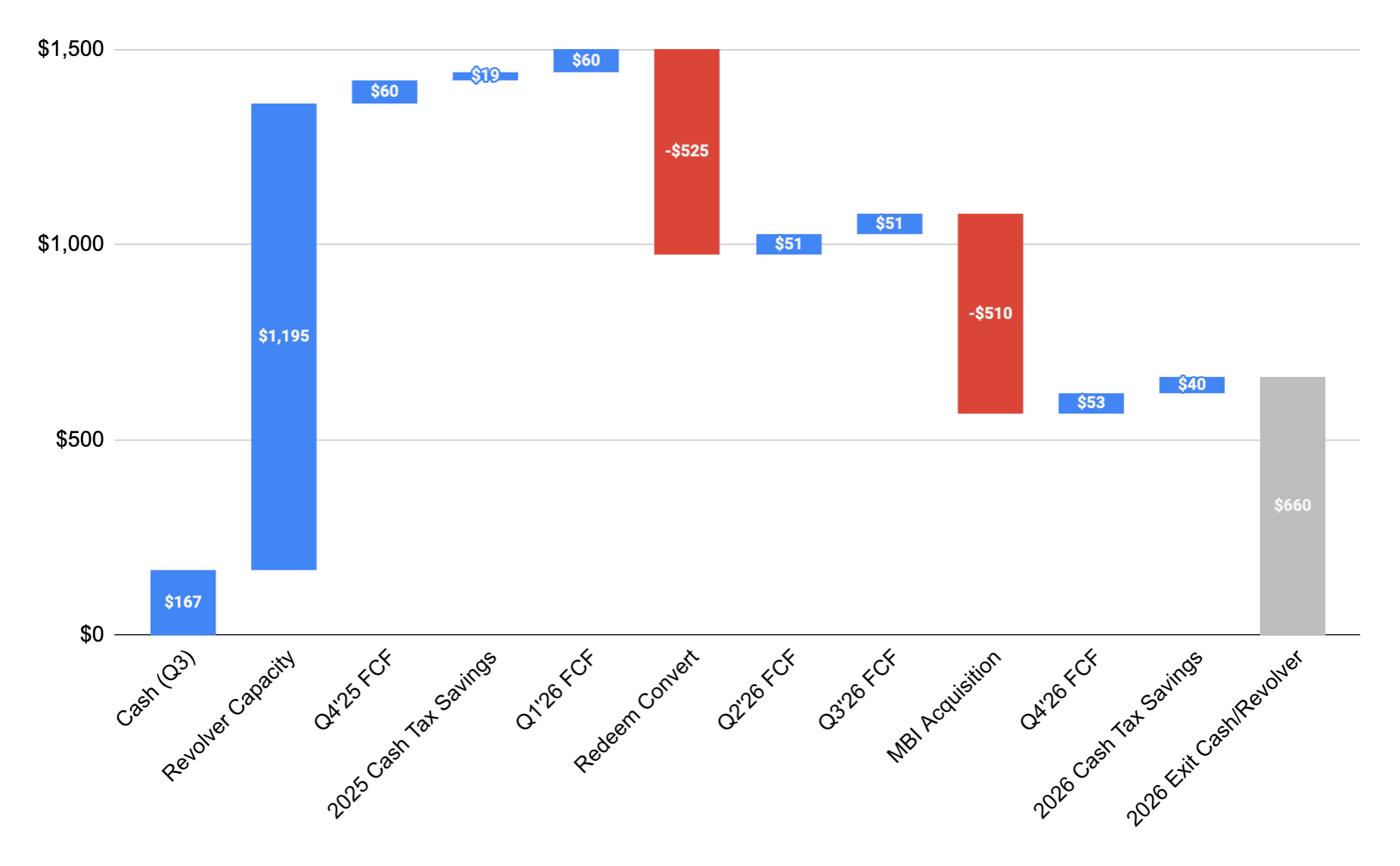

My original post on Cable One (Let's Revisit $CABO) provided a bridge for the balance sheet based on some assumptions around FCF and one-off cash events. It also tried to stress test the revenue decline trends to provide some intuition for when things are better- or worse-than expected.

Q3 earnings were just released, so it's time to check in on those assumptions/trends. Fittingly (for my pun on the ticker), I'm sitting on a beach while I write this.

The Balance Sheet

In my original article I assumed Cable One could maintain at least $60M/q in FCF for the next few years. Q3 came in at $63.8M after you back out the cash benefit of the recent tax law, so things looking good there.

I also highlighted two potential cash sources mentioned in recent earnings calls. The CFO projected a $40M cash tax benefit of the new tax law in 2025, and the Q3 statement of cash flows shows $20.8M, so that is also on track.

The CFO also mentioned that they had monetized Metronet in early July, and they were on track to monetize Ziply by year end. Proceeds for the pair were estimated to be "in excess of $100M". The Q3 filing shows $123M cash from sales of equity investments, so this came in a bit better than expected.

In my original bridge, I assumed the FCF and cash tax benefit, but not the equity sales, since they seemed less certain. As such, the $123M is "found money" that derisks the assumptions a bit.

Happily, they used all the excess cash to pay down debt. They repurchased another $20.4M of the 2030 Senior Notes (recall they've been doing this at a 20+% discount due to low 4% rate). They also paid $173M more on the revolver, reducing the balance to $55M.

Taken together, this increases my projected 2026 exit liquidity by $81M to $660M.

Recall I estimated that Cable One needed to refinance $1.7B in 2028. This is closer to $1.6B now.

Revenue

The good news is my revenue prediction for the quarter was almost spot on. Q3 revenues were $376M against my $376.3M prediction. Expenses were essentially flat, up 0.7% YoY. Again, this is impressive given the inflationary environment.

The worrying bit is that data PSUs, the main barometer of "increasing competition", declined by 4.7% YoY, well outside the 2% average bleed of the last six quarters. They made up for part of this by increasing residential data ARPU by 3.2%. (Or perhaps the ARPU increase motivated some switching, who knows.)

Business services ARPU also showed a sharp 6.8% decline, exceeding the 3% average of the last six quarters.

Conclusion

The balance sheet is improving ahead of pace thanks to the better-than-expected sale of some equity investees (Metronet and Ziply). Revenue is holding up (or declining as expected), but looks worse than expected under the hood, as PSUs decline more rapidly than expected.

The PSU figure is especially worrisome since we should be out of the distortion caused by the end of the Affordable Connectivity subsidies (ended June 1, 2024), which was their excuse for bad YoY PSU comparisons in past calls. Perhaps that hadn't really taken effect in Q3 2024? Something to watch for in the call or next quarter.

I haven't been able to listen to the call, since I'm in a beach chair. Once I do get to listen, I'll add a quick update if there is anything surprising.

Member discussion